Selling Land in a Flood Zone in Florida: What Landowners Need to Know

If you’re selling land in a flood zone in Florida, you’re not alone. Flood zones are common across the state, and they don’t automatically make your land “unsellable”—but they do influence what can be built, who your likely buyers are, and how the property is priced.

This guide breaks down how flood zones work, why they matter, and practical steps you can take to sell with fewer surprises.

How flood zones work in Florida

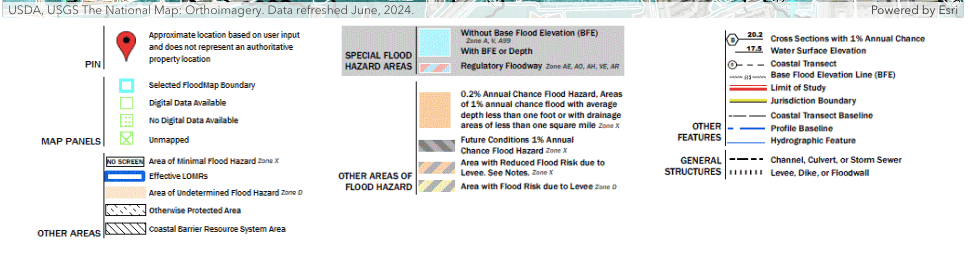

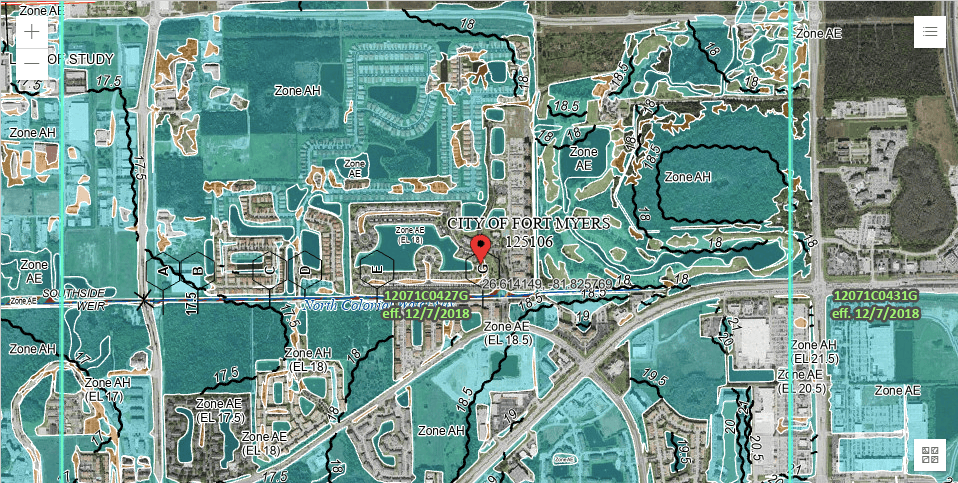

Flood zones are mapped by FEMA on Flood Insurance Rate Maps (FIRMs) and are used to show flood risk and guide building standards and insurance requirements. FEMA’s official public source for flood hazard information is the Flood Map Service Center.

A key term you’ll see is SFHA (Special Flood Hazard Area)—these are higher-risk areas identified on FIRMs.

Common FEMA zones you’ll see (in plain English)

- A / AE: High-risk areas with a 1% annual chance of flooding (often called the “100-year floodplain”). AE zones often include a Base Flood Elevation (BFE) number that affects building requirements.

- V / VE: Coastal high-hazard areas where wave action is a major factor (typically the most restrictive/expensive to build in).

- X: Lower-to-moderate risk (often outside the SFHA). Some X zones still represent a 0.2% annual chance flood area (“500-year”).

Why flood zones matter when selling land

When you’re selling land in a flood zone in Florida, buyers are usually thinking about a few things immediately:

1) Development limits and permitting complexity

Flood zones can trigger stricter rules for building elevation, fill, drainage, and site design. Most Florida counties and cities have a floodplain management process tied to FEMA maps and local permitting.

2) Cost to build (and feasibility)

Even if building is allowed, the cost can increase because buyers may need:

- Elevated foundations (or specific construction methods)

- Engineering/ drainage plans

- Extra permitting steps

- Compliance with local floodplain rules

3) Insurance implications (important for end buyers)

If a future buyer plans to finance construction with certain mortgages, flood insurance requirements may come into play depending on the zone and lender rules (especially in SFHAs). Miami-Dade County Florida tops the list for a “flood prone” county!

How being in a flood zone affects land value

Flood zones don’t “set” a price, but they often reduce what buyers are willing to pay because:

- The buyer pool is smaller (fewer retail buyers, more investor/developer types)

- The buildable footprint may shrink due to elevation/drainage requirements

- The total cost to build goes up (which pushes land price down)

- Timeframes can increase due to permitting/engineering

Practical way to think about it:

Land is often valued based on usable potential, not just acreage—especially when you’re selling land in a flood zone in Florida.

Step-by-step: what to check before you list or negotiate

Step 1) Confirm the flood zone on an official source

Start with FEMA’s Flood Map Service Center and verify the panel for your parcel.

Step 2) Separate “flood zone” from “evacuation zone”

These are not the same thing. Flood zones are FEMA risk/insurance maps; evacuation zones are typically set by local emergency management.

Step 3) Ask the local floodplain official what building looks like

Most counties/cities have a floodplain manager (or equivalent). They can tell you what’s typically required to build and whether there are known constraints for that area.

Step 4) Understand whether an Elevation Certificate is relevant

An Elevation Certificate (EC) documents key building elevations relative to the floodplain and is used for floodplain management compliance and can affect flood insurance costs for structures.

(For vacant land, an EC is more relevant once a structure is planned—still, buyers may ask about BFE and build strategy.)

Selling strategies for land in a flood zone

When selling land in a flood zone in Florida, the best outcomes usually come from aligning price, marketing, and documentation upfront.

1) Price it based on “build reality,” not just comps

If you compare your lot to a nearby lot that’s not in the same flood zone (or has a different BFE), your pricing may be off. A good approach is to:

- Compare to similar flood zone lots

- Consider whether the lot is coastal (V/VE) vs inland (A/AE)

- Consider whether fill/elevation work is likely

2) Market to the right buyers

Flood-zone lots often sell best when positioned for:

- Builders/developers familiar with floodplain rules

- Investors who price risk correctly

- Recreational/holding buyers (depending on location)

3) Be transparent early (this prevents failed contracts)

A lot of deals fall apart when flood-zone details are discovered late. The smoothest sales happen when the listing/marketing clearly states:

- The FEMA flood zone designation

- Any known BFE info (if applicable)

- Any known drainage/easement constraints

4) Offer “next-step” clarity

You don’t need to solve every engineering question, but you can reduce buyer uncertainty by pointing them to:

- FEMA map link/panel

- Local floodplain contact or permitting page

- Any prior surveys, site plans, or county notes you already have

Common questions landowners have

Can I still sell land in a flood zone in Florida?

Yes. Flood zones affect terms and pricing, not whether the land can be sold.

Does a flood zone mean I can’t build?

Not necessarily. Many flood-zone properties are buildable, but requirements vary by zone, BFE, and local regulations. The most reliable answer comes from local permitting/floodplain officials and the specific FEMA map panel.

Should I do anything before selling?

Often the best “pre-work” is simply confirming the flood zone and gathering basic documentation so the buyer doesn’t discover surprises during due diligence.

Helpful resource (link back to your hub)

This guide is part of our broader resource on Selling Land With Issues in Florida, which covers common challenges such as wetlands, zoning restrictions, protected wildlife, conservation land, flood zones, and other factors that can affect land value and development. If your property has more than one issue, our main guide can help you better understand your options: Selling Land With Issues in Florida

Get Started: Get Your Cash Offer Below…

We are direct land buyers. There are no commissions or fees and no obligation whatsoever. Start below by sharing where your property is and where we can send your offer…